Generational Investing: the world according to Generation Selfie (part

>

“According to Alexis de Tocqueville, every generation is a new people. In this two-part article, Dr Paul Redmond presents an overview of Generational theory and an insight into how understanding generations can provide a powerful insight into investment behaviour. ”

‘Each new generation is a new people’

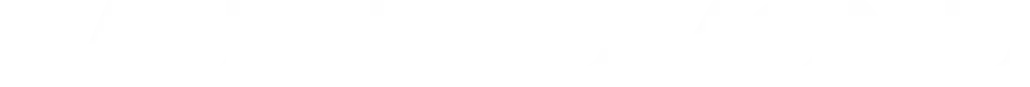

In ‘Democracy in America’, French political thinker Alexis de Tocqueville wrote, ‘Amongst democratic nations, each generation is a new people.’[i] In recent years this theory has been amply tested. As a result, almost 200 years after the publication of de Tocqueville’s seminal work, more information has been collected about today’s five generations than about any in history – not only in the West, but across the world. For business leaders and analysts, this knowledge offers numerous benefits. Extensive research is now available to provide a unique insight into how each generation thinks, behaves, and invests resources.

The aim of this article is threefold. First, it will provide a brief overview of generational theory, one of the most exciting and innovative theories to have emerged in recent years from the fields of sociology and demographics. Next, the article will focus on Generation Y – the ‘digital natives’[ii] who are currently transforming (and being themselves transformed) by the combined forces of technology, globalisation and values. Finally, the article offers key insights into how Generation Y are predicted to behave as investors and consumers.

Generation Y: the first digital natives

Generation Y (also referred to as ‘Millennials’) were born between 1980 and 1999 and, over the next decade, are on course to overtake the Baby Boomers to become the world’s largest generation. Globally, there are over 2 billion members of Generation Y, with 86% living in emerging markets.[iii] The impact of Generation Y will transform the workplace. Estimates are that by 2025, Generation Y will account for 75% of the global workforce.

While the Baby Boomers remain the generation that possesses the financial clout to outspend all other generations, there are signs that this prominence is set to wane. Generation Y is rapidly becoming the new economic powerhouse – in 2015 accounting for $1.3trn in consumer spending (by 2025 this figure is expected to reach $8.3trn in the US alone). None of this is accidental. Much of the wealth of Generation Y is being transferred to them by their Baby Boomer parents – an unprecedented $40trn inter-generational gift that analysts have termed ‘the Great Transfer’.

Members of Generation Y are commonly referred to as the world’s first ‘digital natives’ – the first generation in history for whom computers are not strictly speaking ‘technology’ (the rule of thumb is if it’s been around before you were born, it’s not ‘technology’). As far as Generation Y is concerned the Internet has always existed, telephones have always been mobile, cameras have always been digital. With a default global mind-set Generation Y is naturally entrepreneurial, working ‘with’ organisations rather than ‘for’ them, and looking to take career breaks within the first five years after university.

Generation Y: motivations and priorities

Central to the Generation Y mind-set are authenticity and sharing. In a study by US Trust, 67% of Millennials claimed that their investment decisions were a way to ‘express their social, political or environmental values’. Accompanying this is a strong sense of independence. More than six out of ten Generation Y graduates intend to switch careers frequently during their working lifetimes. This compared to 84% of Baby Boomers who said they intended to remain in the same job for the rest of their working lives.

But this doesn’t mean that Generation Y isn’t ambitious. In a recent survey by PricewaterhouseCoopers, 52% of graduates said that the defining quality which would make a prospective employer attractive to them was the possibility of career advancement. 65% of respondents identified the opportunity for personal development.

Unlike Generation X, Generation Y is motivated by civic and global values. With a global outlook, Generation Y has a strong sense of right and wrong – which it sense-checks via social media. At work, Generation Y expects to be treated fairly and equitably – from day one. Running in parallel to this is a demand that organisations remain true to their stated corporate social responsibility (CSR) strategies.

Generation Y as future investors

My own research has highlighted the impact of the 2008 economic downturn on the financial confidence and outlook of Generation Y.[iv] This downturn, first highlighted by the bankruptcy of Lehman Brothers, led to a generation-wide loss of faith in some high street financial institutions – a loss which, paradoxically, has left Generation Y in a ‘double-bind.’ On paper, they are the most educated and qualified generation in history. And yet in Europe alone, the spiraling costs of housing means that just under half of them still live at home with their parents. According to a study by Accenture, 80% of Generation Y believes that the economic downturn has taught them the importance of accumulated savings. Nevertheless, almost half have yet to start saving for retirement.

Generation Y’s lack of financial literacy is well documented along with a growing sense of alienation from high street banking institutions. According to Scratch Viacom’s ‘Millennial Disruption Index’ (MDI), 53% of Millennials fail to see any difference between what their current bank offers them versus its competitors. Partly this is down to a growing generational gap which is emerging between traditional banks and Generation Y.

‘YOLO’ (you only live once): Generation Y markets

Research shows that Generation Y inhabits a ‘sharing economy’, in which access to services and products are afforded a greater level of importance than purchases. Whereas earlier generations attached value to prestige purchases, Generation Y prioritises lived experiences – all of which, in order to register value, have to be socially referenced via social media. This constant social referencing is a key generational characteristic: unless an activity, experience or purchase has been shared via social media, as far as Generation Y is concerned, it does not fully exist. ‘Reality’ for this generation is not nearly as interesting as the story they will tell about it later via social media.

The growth of the sharing economy, coupled with Generation Y’s propensity to invest in services and experiences, means that potentially lucrative investment opportunities should arise in markets in which sharing opportunities are prevalent. Examples are shared finance, shared accommodation (an example of which is Airbnb), car sharing and car rentals, music and video streaming, hotel rooms, access to luxury goods, property sharing, self-storage and asset sharing. With their capacity to trigger the inner Generation Y entrepreneur, industries which provide opportunities for ‘C2C’ (customer-to-customer) transactions will be particularly important to Generation Y consumers.

C2C and F2F

Of course, what allows each of these areas to thrive and multiply is their almost seamless capacity to involve a strong digital interface. For Generation Y, accessing a product or service via the internet is a given. There is, however, a caveat. When seeking financial advice, my own research found that Generation Y still prefers ’F2F’ (face-to-face) interaction with a skilled financial adviser. In this, Generation Y reflects the values of previous generations. The only difference is that Generation Y expects the adviser to be available whenever he or she is required. No doubt this is another reason why high street banks are struggling to gain the attention of younger consumers.

Generational investing: the world according to generation selfie (part 2)

Dr Paul Redmond, Director of Student Life at the University of Manchester in the UK, explains the key findings of his work on ‘generational theory’ and the implications in a fast changing world. In this, the second of a two part series, Dr Redmond explains the implications for global businesses of aligning themselves with the values of Generation Y. He explores the importance of ‘authentic’ experiencesand reveals the three key messages that businesses need to heed to attract and retain Generation Y.

Part 2: Channeled disruption: attracting and retaining Generation Y

‘Burgernomics’

An example of the disruptive impact of Generation Y on established business models has recently appeared in the high street in the form of a US hamburger franchise called ‘Five Guys’. Originally a family business, Five Guys is taking a bite from the burger business, which in the UK, as in other countries, remains heavily dominated by Baby Boomer and Generation X leviathans such as McDonald’s and Burger King. With over 1,000 restaurants globally, Five Guys is based on core Generation Y values: there is a strong emphasis on providing an ‘authentic’ experience, a dependency on ‘flash-mob’ word of mouth and social media marketing campaigns, a strong focus on values, eg, eating healthy and wellbeing, an engagement with the local community and an obsession with getting the product right (this was the firm that refused to deliver hamburgers to the US Pentagon – arguing that running a delivery service would reduce the quality of the product). In applying this core Generation Y business model, suddenly the old and established ‘Boomerist’ market leaders look distinctly out of touch, corporately hidebound and dated. The fact that the big burger chains sell cheaper burgers barely registers. Businesses like Five Guys have demonstrated that markets aimed at Generation Y do not have to be primarily price-sensitive. Far more important is the authenticity of the experience and the capacity to live up to the brand values.

The success of firms such as Five Guys offer useful insights into how future businesses will need to compete if they are to attract and retain Generation Y consumers. Generation Y is almost naturally collaborative and places a strong emphasis on peer recommendations. Much of this is driven by social media, which now plays a powerful role in shaping Generation Y’s view of the world.

This is hardly surprising – the statistics alone are staggering. Generation Y owns more digital devices than any other generation. Studies show that globally, 94% of the cohort possesses a cell phone; 76% a smart phone; 70% a laptop; 69% an iPod/MP3 player; 63% a games console. Generation Y is the world’s first generation to have effectively digitised its leisure time.

Implications for organisations

For global businesses, the rise of Generation Y highlights a range of challenges. It is no surprise that many of today’s leading firms were built by Baby Boomers for Baby Boomers. As such, they reward traditional Boomer values such as loyalty, tradition, and top-down command and control models.

To attract and retain Generation Y – both as investors and employees – there are three key messages that all businesses need to heed:

1) New psychological contract

Unlike previous cohorts, Generation Y works ‘with’ organisations rather than ‘for’ them. This represents a major change in the traditional psychological contract between employers and employees. Where once employees would sell their time, often years in advance, in return for a regular pay check, Generation Y is motivated primarily by opportunities for career development and personal growth. Employers that can make the shift from the traditional to the new psychological contract will have a head start in recruiting and retaining Generation Y talent.

2) Living up to the value proposition

Generation Y is highly motivated by values and a sense of justice. Thanks to social media, organisations that fail to live up to their value proposition are at risk of being found out and publicly exposed. Walking the walk is a key Generation Y attribute that leading firms are quick to recognise and apply.

3. Managing social media

Globally, 90% of Generation Y employees have a social media profile. Facebook alone has over 1.4 billion monthly users and 930 million active daily users. For organisations, social media represents an opportunity and a threat – an opportunity, in that social media platforms provide an excellent opportunity for engaging with new online communities and by-passing traditional marketing barriers; a threat, in that unless businesses appoint social media managers, there is a danger that the business could find itself in one of the all too frequent social media firestorms that frequently light-up the Twittersphere. The message for business is simple: manage social media before it manages you.

Selected references

[i] ‘Democracy in America’, de Tocqueville, A. (1835)

[ii] ‘Digital Natives, Digital Immigrants’, Prensky, M.: On the Horizon Journal (MCB University Press, Vol. 9 No. 5, October 2001).

[iii] ‘Generation Next – Millennials Primer’, report by Bank of America Merrill Lynch (2015)

[iv] ‘Generations Apart: exploring employee benefits solutions for today’s workplace’, Redmond, P, White Paper Report for Barclays plc (2013).